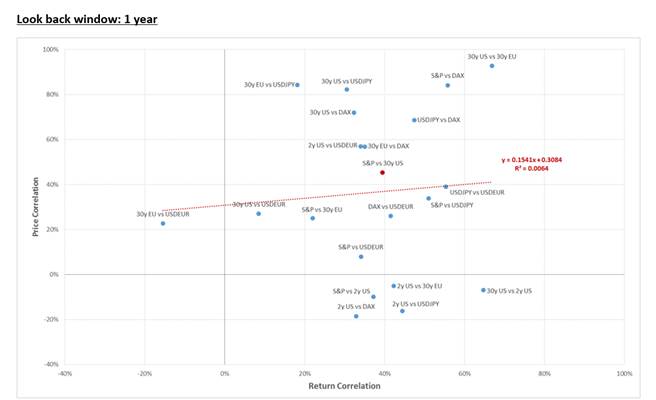

Once you realise how central desire is to processing information and making decisions, you can appreciate how important it is to be able to deal with it. Just being aware of your desires as we discussed in the previous article sometimes is not enough. The process of investment has a direct impact on your emotions and desires – “Fear and Greed” are well known but that does not make them easy to deal with.

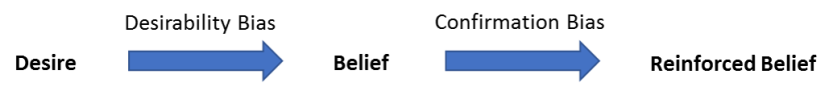

If you are not careful, this will be your process

- Belief leads to investment

- The investment leads to the desire it will succeed

- Desire leads to reinforced belief in the trade

- The belief leads to confirmation bias

- The confirmation bias leads to even stronger belief.

By this stage, your emotional ties have now blended with your beliefs

- The risk is that you cannot process new information correctly

- You do not get out of the trade when you should and lose money

Introducing the stop-loss

The cycle above is often why books on trading make stop-losses a central element. In fact they are ubiquitous in trading culture, as a hedge fund manager investors would often ask where my stop-loss is on a given position. The theory is clear:

“If you have a rigid and clear stop-loss, which you decide before you enter a trade, and then remain disciplined in sticking to it, then you are protecting yourself from your own inability to objectively evaluate the position after you have put it on.”

This is great advice for most investors. Another great piece of advice would be:

“DON’T TRADE – you aren’t any good at it and will lose money”

The books tend not to mention that one.

IS there an alternative?

A problem with a stop-loss is the trade might still be a great trade. In fact, it could be better or worse that when you initially traded. New information will have become available, but by pre-committing to get out of the trade, you are not able to do anything about it.

There are other ways to manage positions aside from stop-losses. I borrowed a helpful way to think about this problem from George Soros – please read “The Alchemy of Finance” – a truly wonderful book with some very important ideas. One of Soros’ key ideas is the application of Popper’s scientific method to investing. The application of hypothesis testing.

- Key is not to start with a “belief” that the trade will work, in fact the trade is a test of the hypothesis that the trade will do well.

- Analysis is therefore considering what would falsify this hypothesis.

- Hypotheses are falsified all the time and it is nothing to get very excited about.

Therefore, desire is not engaged or at least minimised.

- This willing suspension of belief is critical to being able to remain objective later.

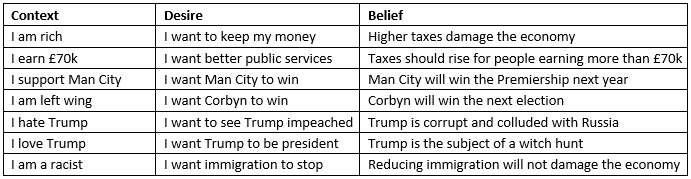

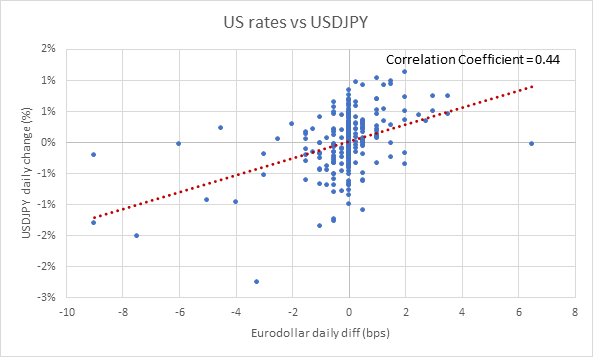

What can falsify a hypothesis. For example

- Fundamental news invalidating the underlying idea

- Price action that tells me what I thought matters in this market, is not what really matters

- Price action that tells me there is something going on I do not understand.

In practice, this can look very similar to a stop-loss, but It leaves the door open to more discretion and flexibility. For example:

- Fundamentals have worsened while the price action is fine

EXIT i.e. do not wait for the stop-loss - Fundamentals have improved while price action is poor

Do not automatically exit as some of the most profitable opportunities from these times of material mispricing. Do more investigation.

Possibly INCREASE the position size rather than cut it

Conclusion

Working with Soros, I observed that this process allows him to be enormously flexible. He does not seem to fall into the standard pitfall of emotional attachment to his trades. Instead fluidly cutting, increasing or reversing them when he changes his mind. This level of control and discipline sets him apart from the vast majority of traders I have seen.